Summary Of Problem

"Online, entering incorrect payment information was the most

prevalent cause of transaction failures, causing 25% of canceled

transactions.

~ PYMNTS.com"

From ecommerce stores, to subscription businesses, to platforms and marketplaces, UPAYID addresses all payments needs across channels.

Through your local Issuer, or Wallet Provider or through www.UPAYID.com

With features like Confirmation of Payee (COP), Value/Velocity

Checks, Adherence to Travel Rule (FAFT), PSD2, Section 1033

(Dodd Frank).

With multiple currencies and dozens of payment wallets UPA makes it easy to launch new markets and add your customers’ preferred way of paying to increase conversion abroad.

Payee's preferred way of getting paid (e.g. Bank, Card, Wallet, Crypto, etc.)

Payee’s EXACT payment credentials (specific Account number/IBAN, Card #, Wallet address)

Knowledge of payee full name, address and other details.

Information like value/ velocity limits ahead will help

“routing” of payments by Payer

Successful Person to Person payments would require accurate

knowledge of Payee information to the Payer.

Global

P2P volume grew from $2.62 billion in 2022 to $3.04 billion in

2023 at a compound annual growth rate (CAGR) of 16.4%

Increasing presence of IOT and with adoption of device-bound

payments is leading to ”subscription” economy extended to

short term borrowing of utility vehicles, as well as making

instant purchases

Global IoT payments market is

forecast to be worth US$935 billion in 2024, of which 42% will

be in the Asia- Pacific region, according to a study by

Juniper Research2

NFC based payments through PAYs (Apple Pay, Google Pay,

Samsung Pay) have enabled M-Commerce interactions with

Customers seamless. Merchants are creating Paywalls online to

offer flexibility to Customers how they can pay. Very soon,

Merchants will be required to offer Paywalls even for

M-Commerce

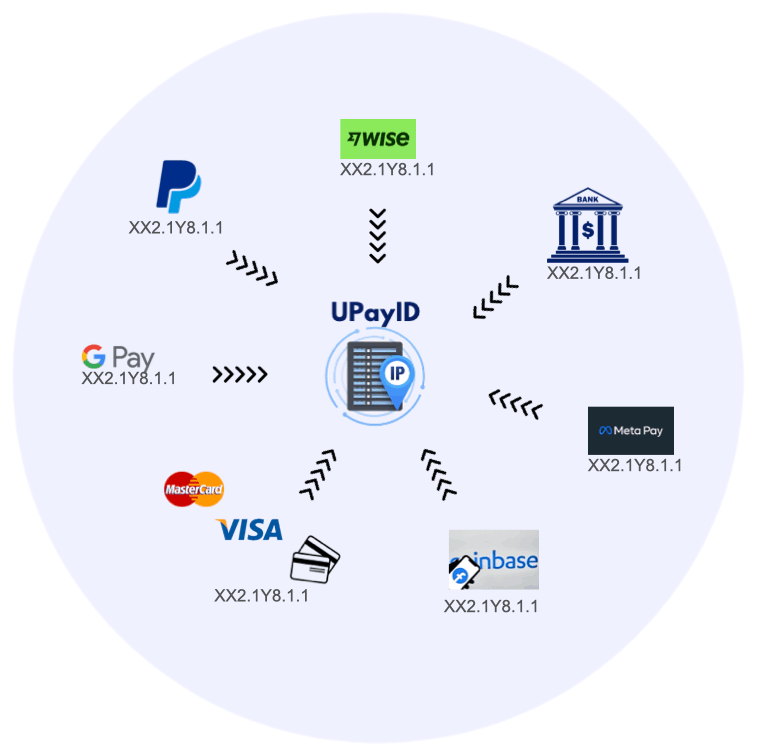

Each payment instrument such as a bank account, card number,

crypto Address (e.g. Coinbase Wallet ID, Metamask ID, etc.) or

Wallet addresses (e.g. Google Pay, Meta Pay, PayPal, etc.) would

have a unique IP address - which is termed a “UPAYID”

By

assigning each payment resource discoverable through standard

Internet Protocols, information about these resources (Payment

Instruments) can be easily transmitted to party requesting. This

process is similar to how a Browser makes a call to DNS Server

to resolve a Domain Name (URL) with an IP address, to GET the

information/Content.

APPS

UPAYID transforms every Payment credential associated with a

Payee (Beneficiary) into a "Universal Payment Resource."

Payees are required to register each payment instrument’s

credential (such as Bank Accounts, Credit/Debit Cards, Wallet

IDs, Crypto End Points, etc.) in the UPAYID repository. Upon

registration, an IP Address is assigned, linked to the Payee's

Beneficiary ID (alias), which can be a Phone number, Email,

LinkedIn ID, Twitter ID, or any other Identifier. These links

between Identifiers and IP Addresses are made accessible

globally through a Payment DNS server

Note: Users

have the option to establish access controls and authorization

workflows, including two-factor authentication (2FA), to

facilitate the granting of permissions in compliance with

GDPR/CCP.